Bet Sizing Tool

By Fraser Walker in Sports Betting

July 18, 2023

Introduction

This year I’ve taken to gambling on pro golf tournaments, and one of my favourite markets to bet on is Tournament Outrights,ie: who is going to win the tournament. I’ll identify several players I like that week and construct a portfolio of outright bets from them.

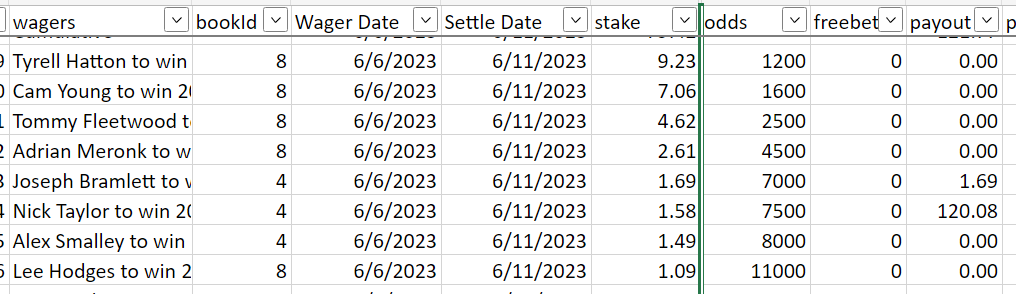

Typically what I’ve done is first decide on a Payout Target I want to achieve should one of my wagers hit; at most one and only one of the wagers in the portfolio can hit because each wager is necessarily mutually exclusive. Then I work backwards to figure out what to wager on each player such that I’m agnostic to who specifically wins among them, since they would all payout the same. A recent example from the 2023 RBC Canadian Open,

You could equivalently lump all the individual bets together and treat them as one, “Hatton, or Young, or Fleetwood, …” etc. with +414 odds1.

What has concerned me with this approach is that by setting the Payout Target first, the Total Stake (how much I am to wager) is then entirely decided by the odds I can get for the players in my portfolio. This has led to questionably large Stakes pre-tournament that I did not really intend for. This type of bet is not going to hit very often so I’d rather treat it as a lottery ticket; that a down 100% week is only a nominal sum and not substantial – at least in relation to the potential payout2.

Fixing the Stake

Instead of setting the Payout Target and working towards the Total Stake, what if I did my process in the reverse. I begin by saying I only want to spend $ \(k\) and for all wagers \(\mathsf{w} = \{w_{1},w_{2},...\}\) in my portfolio, I want the payout to be the same in the event that one should hit. That is,

$$

\mathsf{max.} \quad w_{1}o_{1}

$$

s.t.

$$

\sum_{w_{i} \in \mathsf{w}}{w_{i}} = k \

\forall i \neq j: w_{i}o_{i} = w_{j}o_{j}

$$

where \(o_{i}\) is the odds in decimal format given for for wager \(w_{i}\). This is straightforward enough that it has an analytical solution,

$$ A\mathsf{w} = b \implies \mathsf{w} = A^{-1}b $$

provided that \(A\) is invertible, which it will be. The system of linear equations is,

$$

\begin{bmatrix}

o_{1} & o_{2} & o_{3} & ... & o_{n} \\

o_{1} & -o_{2} & 0 & ... & 0 \\

o_{1} & 0 & -o_{3} & ... & 0 \\

\vdots & \vdots & \vdots & \ddots & \vdots \\

o_{1} & 0 & 0 & -o_{n-1} & 0 \\

\end{bmatrix}

\begin{bmatrix}

w_{1} \\

w_{2} \\

w_{3} \\

\vdots \\

w_{n} \\

\end{bmatrix} =

\begin{bmatrix}

k \\

0 \\

0 \\

\vdots \\

0 \\

\end{bmatrix}

$$

and we just need to solve for \(\mathsf{w}\).

Interactive Bet Sizing Tool

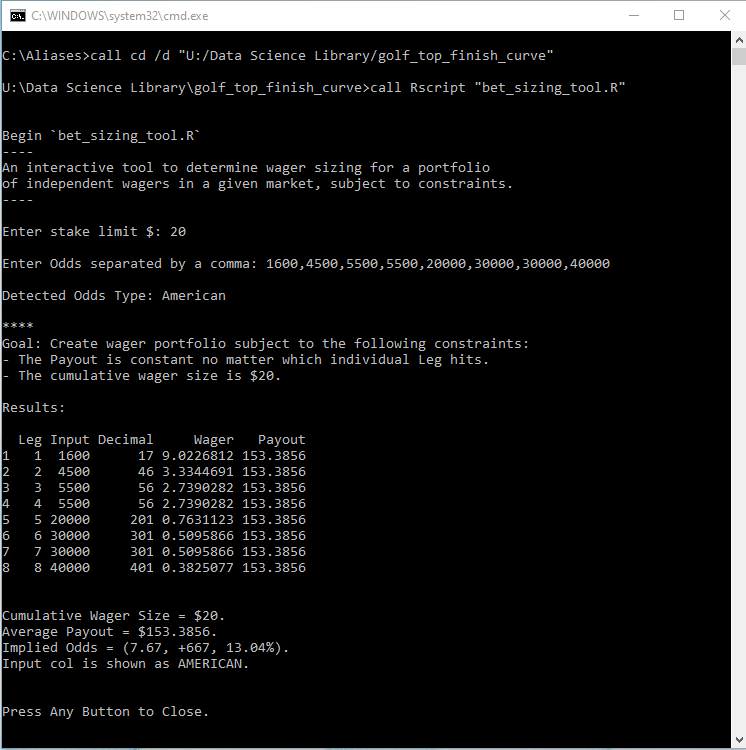

I put together a little interactive cmd line tool with R to help me construct my outright portfolio on the fly when I’m checking out the available odds early in the week. I give it the Total Stake, I give it the Odds and it spits out the solution to the system of linear equations above. For example, with the 3M Open this week I only wanted to spend $20 and I identified 8 players I liked,

And the tool returns the suggested portfolio to meet these constraints. We can then calculate the implied odds of the portfolio to be about +667 or ~13%.

-

Here we can calculate the (decimal) odds

\(o\)as\(o=\frac{P}{\mathsf{w}}\)where\(P\)is the Payout if the wager hits, and\(w\)is the staked amount.] ↩︎ -

For the 2023 PGA Championship, I had $56 wagered pre-tournament across five players (+311 implied odds) with only Scottie Scheffler even close to contention on Sunday. ↩︎